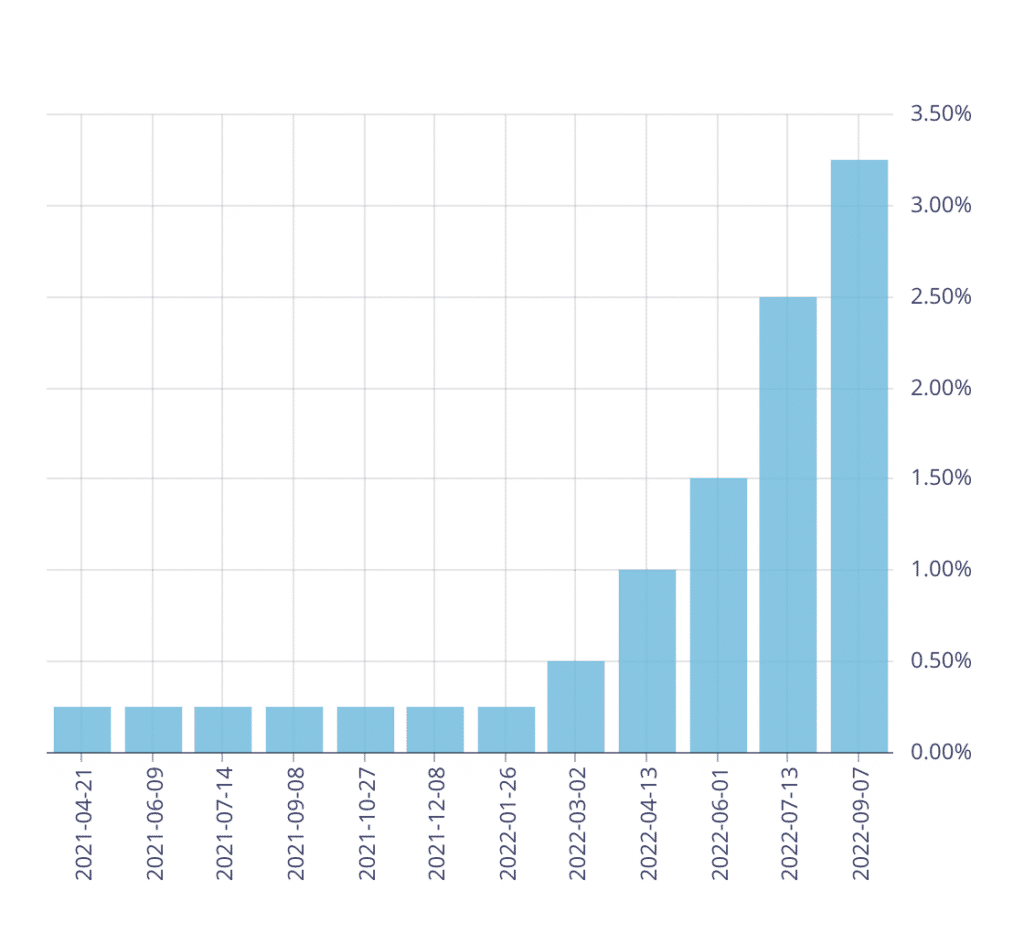

In today’s rising interest rate environment, a variable mortgage seems wrought with issues. Since the beginning of 2022, purchasers with a variable rate have seen the overnight rate shoot up 3%. For those who have recently bought a home in Toronto, this has resulted in a sharp rise in the monthly payment. However, for those with a variable mortgage possessing constant payments, the principal payments have diminished, potentially beyond the trigger rate.

What is The Trigger Rate?

The Trigger Rate is the interest rate when the monthly obligation of a fixed payment, variable rate mortgage does not serve the outstanding debt.

To understand just how the trigger rate affects the everyday mortgage holder, one must first understand some basic mortgage terms to better understand how mortgages affect them.

Closed vs Open

Every mortgage in Canada is either considered closed or open. A closed mortgage means that the mortgagor (borrower) is obligated to hold the mortgage for the length of the term. The most common term length in Canada is 5 years, though some banks offer different durations, such as 3 year options.

Should the borrower wish to close the obligation (by, for example, selling the property), a prepayment penalty applies. This penalty essentially allows the lender to recoup some lost interest to which it was originally entitled. The most common prepayment penalty is 3 months worth of interest on the loan.

Conversely, in an open loan, the mortgage can be repaid at any time without any penalty whatsoever. Open mortgages typically carry higher interest rates, as there is no guarantee the lender will earn the interest for the entire length of the loan.

Amortization

The amortization is the length for which the loan is designed. The term of the mortgage is typically less than the amortization. While most Canadian mortgages are 5 years in length, they are designed as if full repayment would be achieved in 25 years. However, after the first 5 of the 25 years, the mortgage is up for renewal (usually at a different rate).

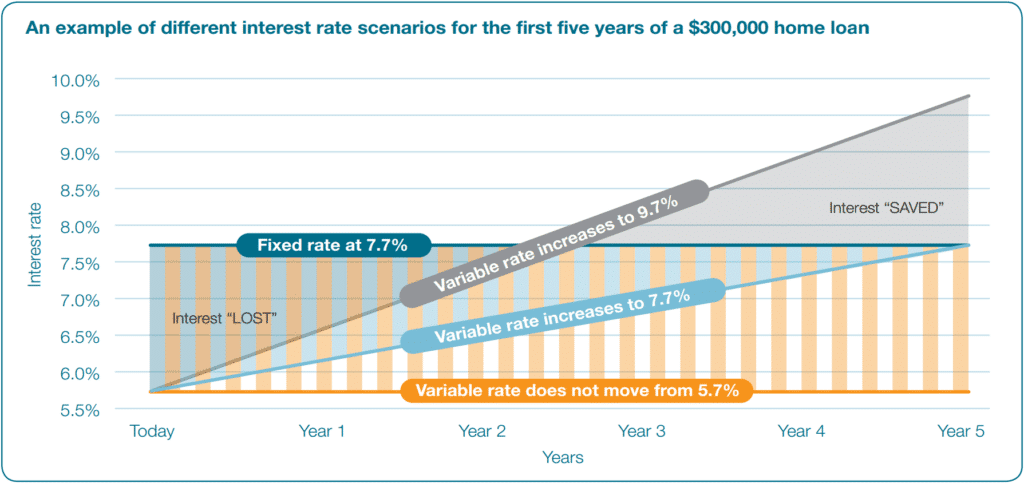

Variable VS Fixed Rate Mortgage

A fixed mortgage carries a set, unchanging interest rate through the length of the term. Upon signing, the borrower and lender agree to a specific rate or rates that will hold for the duration of the mortgage. No changes can be made to this rate once the mortgage has begun.

A variable mortgage, however, works by setting a relative interest rate. The lender chooses a benchmark to base their lending interest rate (from either the prime rate in Canada, or the overnight rate) and as this benchmark changes, so does the interest rate of the loan.

Variable mortgages can be closed or open. An open variable mortgage is essentially an open-ended loan that can be repaid at any time. During the time the loan is active, the borrower pays market rates. A closed variable mortgage is a lending option where the borrower is committed to pay the market rate, whatever it may be, for the length of the term.

Payments: Fixed or Variable

Most commonly in a variable rate mortgage, changes to the interest rate automatically affect the payment amount. Each payment will be allocated towards a certain amount of principal repayment, and the balance to repay interest accrued. As the interest rate rises, variable payments rise with it.

However, if the borrower elects to have the payment fixed throughout the term, the payment’s allocation of principal and interest will shift to ensure that any interest accrued is covered, with the balance repaying principal. This, in turn, shifts the amortization of the mortgage. Instead of

Putting it all Together: The Trigger Rate

Now that we’ve rocketed through the terms necessary to understand Canadian Mortgages, we can finally understand the trigger rate.

In a fixed payment, variable rate mortgage (closed OR open), the trigger rate is a reference to the rate at which the bank considers the mortgage “non-performing”. In other words, the total amount paid does not cover a satisfactory amount of principal and interest.

The Trigger Rate is the point at which the bank is no longer satisfied the loan is performing as it should.

Calculating the Trigger Rate

From the definition, it might seem that the trigger rate is simply when 100% (or more) of the payment is allocated to interest and there is no principal repayment. However, each bank has different comfort levels with repayment and amortization lengths, and can set this rate far below the trigger rate.

Trigger Rate Consequences

So, what happens when the mortgage reaches the trigger rate? Typically, borrowers have three options:

- Pay a lump-sum amount against principal to bring the loan back within tolerance,

- Payout the loan, either by sale or refinance, or

- Let the loan default, usually starting Power of Sale proceedings.

Conclusion

Trigger Rates are a complex and diverse topic, but they do not have to be something to fear. Understanding the consequences of a variable rate mortgage with set payments is important prior to getting involved in the purchase of a property. If you have questions about Trigger Rates, contact us.