Interest rates are on the rise almost daily. Since the start of 2022, the overnight rate has risen by 1.25% and is expected to continue its climb. Prime now sits at 3.70%, up from its 2.45% low.

With the rising cost of borrowing and overall buying power shrinking, one question comes to the mind of the investor: is Toronto Real Estate STILL a good investment in 2022?

The answer to that question depends largely on three factors:

- The amount of leverage required to complete the transaction

- Cost of carrying the property and the cost of borrowed funds

- Expected Income on the property & potential capital appreciation

Using two examples and some simple data simulation, we can quickly determine if Toronto Real Estate is a good investment in 2022.

On This Page

Single Family Property Ownership

The most common form of Toronto Real Estate Investment is the purchase of a single family home (house or condo) and leasing the entire property out to one tenant. This is incredibly common with condominiums in Toronto, where it was estimated in 2020 that 36% of all condos in Toronto were leased to tenants.

Using present-day market prices & lease rates, and by calculation of the CAP Rate, we can determine if this style of investment is still profitable in 2022.

Let’s assume our buyer is looking to purchase a 2 bedroom condominium in the Downtown/Waterfront region of Toronto. As of June 2022 (based on a 30-day moving average), the data is as follows:

Part 1: Net Income on the Property

Sale Price: $908,168

Rent: $3,018/month

Property Tax: $3,238/year

Common Elements Fees: $520/month

Assuming that utilities are either included in Common Elements Fees or additional to the rent, the total cost to carry a condominium in downtown Toronto is $790/month.

(n.b. Common Element fees vary widely based on square footage, parking/locker, and type of common elements in a building. We are using the average for calculation purposes, but this expense will greatly influence profitability)

Gross income – Expenses = Net Operating Income (NOI)

Using the above formula, we achieve a calculated Net Operating Income (NOI) of $2,228/month.

This equates to a CAP Rate of 2.94%.

CAP Rate = NOI / Purchase Price

Part 2: Cost of Borrowing & Analysis

As of June 2022, the best interest rate from a “big 5 bank” for a 5 year fixed mortgage is 4.09% (Ratehub).

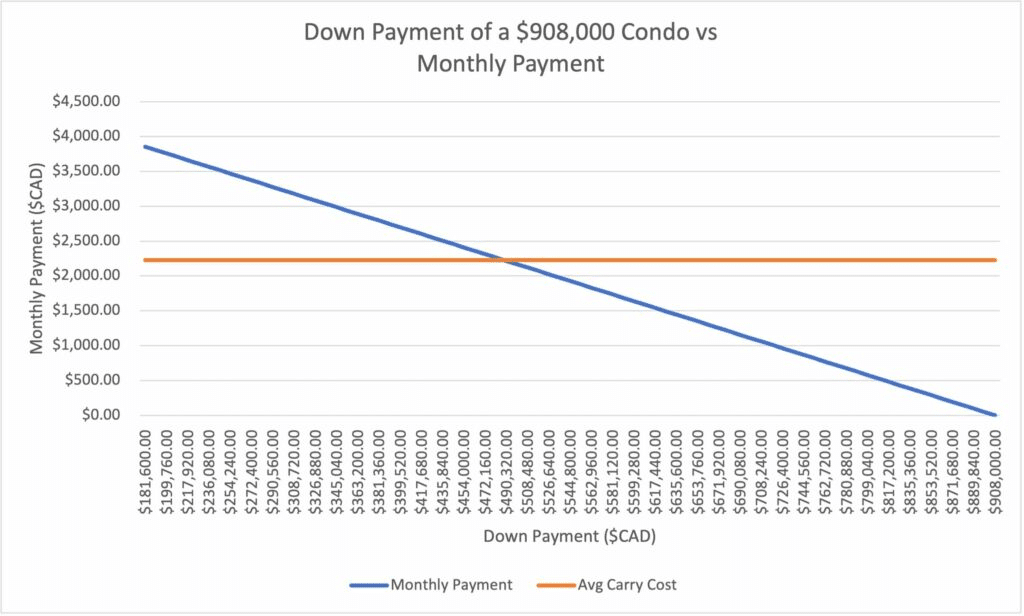

Using simple data modeling, we are able to graph the cost of a monthly payment based on down payment.

We see here that our NET ZERO CASH FLOW point would require us to have a downpayment of roughly $472,000 (or 51%) to have neutral cash flow on a Toronto Condo. (neutral cash flow meaning the condo does not produce after-carry profits, nor does it require money)

The Addition of Land Transfer Tax ($29,270) and Legal fees ($1,500) totals a required cash investment of $502,770 – or 55% -for a Toronto Condo to produce monthly cashflow for the average owner.

Part 3: Internal Rate of Return

We have determined the investment required to neutralize cash flow for a downtown Toronto Condo. However, every blended mortgage payment is a combination of principal repayment & interest payment. While the monthly payment doesn’t differ, the portions of principal and interest vary slightly per payment due to amortization.

However, based on our downpayment of $472,000 (resulting in no net cashflow), the principal repaid during the 5 year term would be $60,458.27.

This gives way to a concept commonly known as Internal Rate of Return (or IRR).

The IRR is calculated based on the idea that a portion of monthly payments go to oneself. Essentially, through rental income, money is being made on the money borrowed from the bank.

The formula for calculating IRR is:

IRR = CAP rate of investment X amount invested

(472,000 * 0.0294 = $13,876.80)

+Amount Borrowed X (CAP Rate – borrowing interest rate)

(436,000 * [.0294-.0409] = $ -5,014.00)

13,876.80-5014.00 = $8,862.80

$8,862.80 / 472,000 (initial investment) = 1.87%

On a condominium Real Estate Investment with 50% down, an owner can expect to earn 1.87% Internal Return on their money.

Other Considerations

1.87% seems like a pretty meager return on investment for a $472,000 cash outlay. However, this does not take into account any capital appreciation by the asset, as well as the (usual) relative stability of Real Estate when compared to equities.

So, is Toronto Real estate still a good investment? For the time being, it certainly seems like a sure-fire way to continue to “safehaven” large investment amounts. However, with volatile rents, interest rate hikes, and a general cooling consensus of the market, time really will have to tell.