Florida’s stunning beaches and sunny climate continue to attract homebuyers from all over North America, but soaring home prices and property taxes in popular areas like Miami or Palm Beach can make the Sunshine State feel financially daunting. However, not all oceanfront counties come with steep property tax bills. If you’re looking to settle by the sea without breaking the bank, there are still places along Florida’s coast offering remarkably low property taxes in 2024-2025. Here’s a closer look at five coastal counties that could save you thousands each year.

On This Page

Why Property Taxes Matter Now More Than Ever

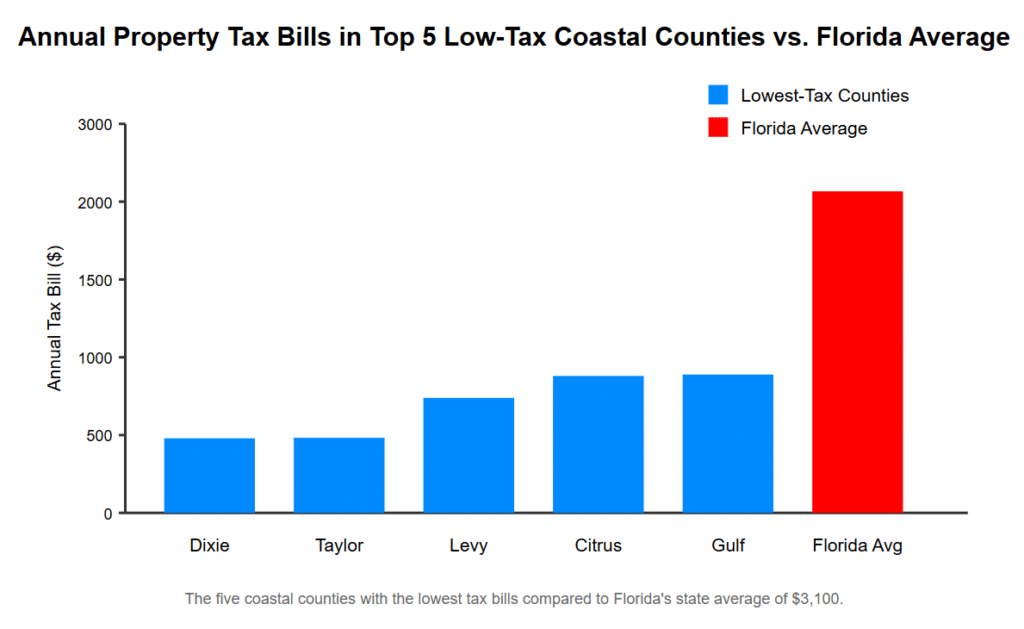

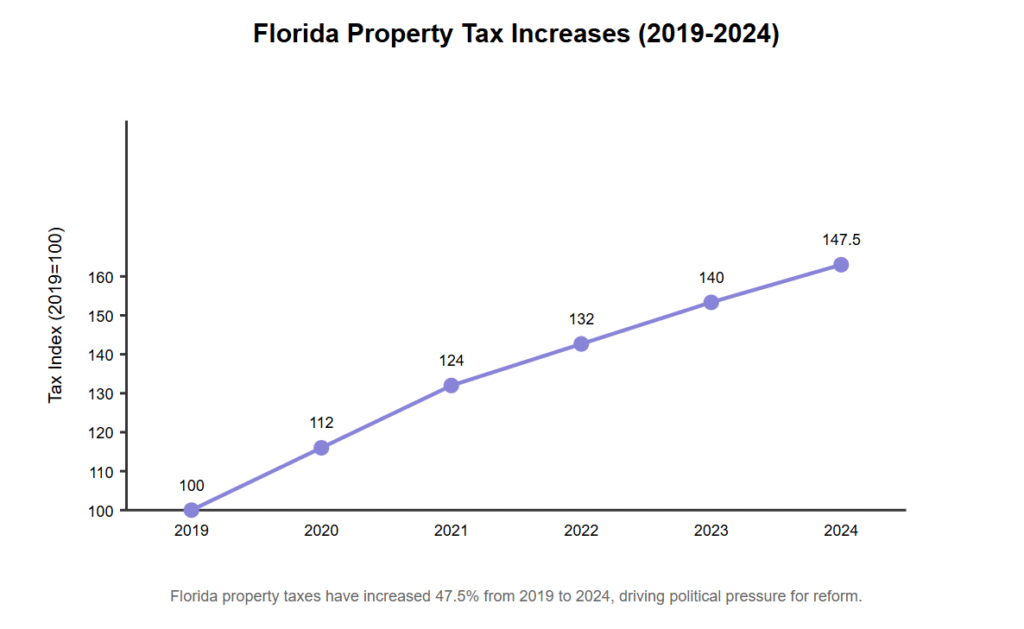

Florida has always drawn retirees, snowbirds, and families alike. But recent years have seen property taxes rise significantly, reflecting Florida’s booming property market and increased demand for coastal real estate. Statewide, the average property tax bill for homeowners now hovers around $3,100 per year. While Governor Ron DeSantis has proposed ambitious reforms, including potential elimination of property taxes altogether, such plans face significant challenges and uncertainties.

Still, as policymakers debate the future, savvy homebuyers are searching out counties that already offer low property tax rates combined with desirable coastal living.

The Top 5 Affordable Coastal Counties

1. Dixie County

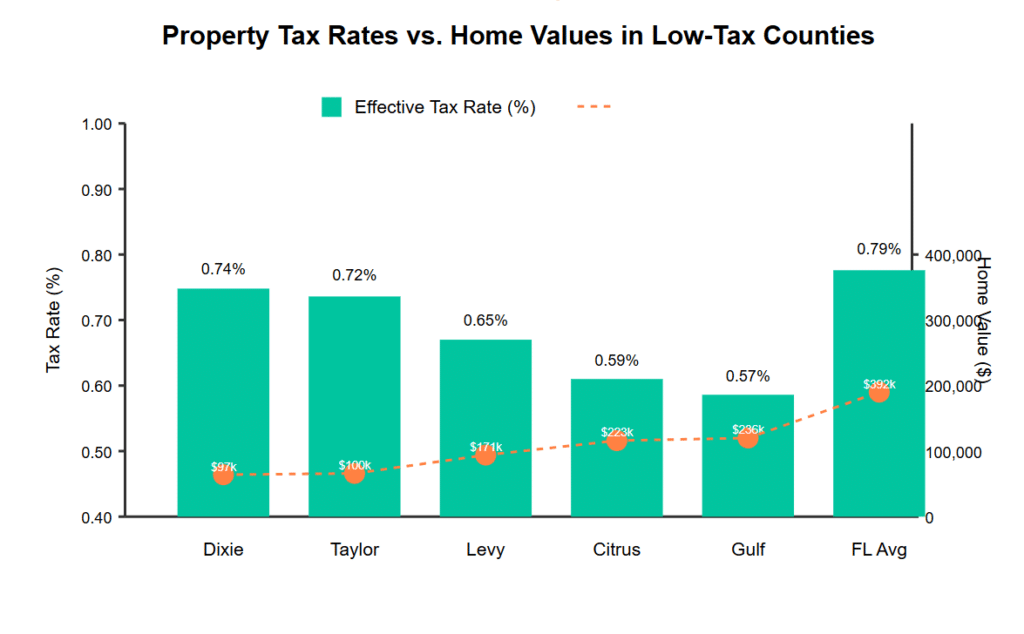

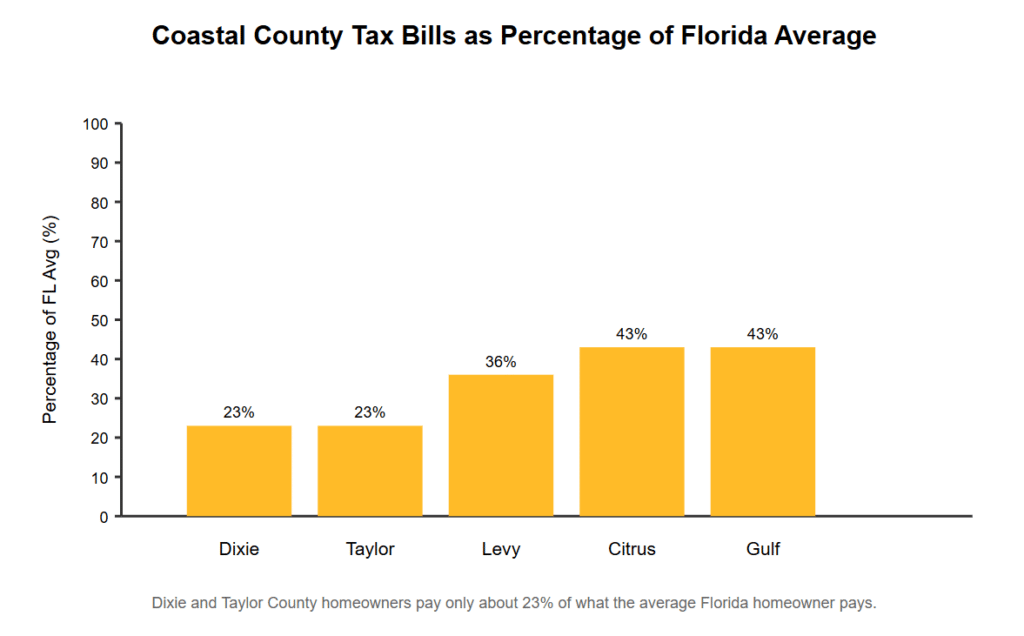

Nestled in the quieter Big Bend region along Florida’s Gulf Coast, Dixie County offers the lowest property taxes in the state. With an average effective tax rate of just 0.74%, homeowners typically pay around $700 per year—nearly 75% less than the statewide average.

Though Dixie County doesn’t boast flashy tourist resorts, its peaceful atmosphere and abundant natural beauty make it a paradise for nature lovers. Waterfront property here is often surprisingly affordable, thanks to modest home values (median around $97,000). However, potential buyers should remember to factor in the significant insurance premiums due to hurricane risks like those posed by Hurricane Idalia in 2023.

2. Taylor County

Just north of Dixie lies Taylor County, another Gulf Coast gem known for its affordable coastal lifestyle. Taylor’s property taxes average around $724 per year, translating to an effective rate of roughly 0.72%. This is an exceptional bargain—only a quarter of the average Florida tax bill.

Taylor County features laid-back coastal towns and ample recreational opportunities like fishing and boating. Like Dixie, homeowners here must be mindful of high insurance costs associated with hurricane exposure. The direct impact of storms, including 2023’s Hurricane Idalia, underscores the importance of comprehensive home insurance.

3. Levy County

A little further south, Levy County offers a unique blend of small-town charm and Gulf Coast tranquility, especially notable in the coastal town of Cedar Key. Levy’s property tax rate sits around 0.65%, resulting in average annual bills of about $1,110—approximately a third of the state average.

Homes here are still attractively priced, averaging around $171,000, and the homestead exemption and property tax caps further protect residents from sharp increases. However, as Cedar Key grows in popularity, vacation property owners without homestead protection could see more rapid increases. Again, insurance premiums for flooding and hurricanes must be carefully considered in budgets.

4. Citrus County

Citrus County, on Florida’s picturesque Nature Coast, strikes an excellent balance between affordability and coastal beauty. Property taxes here average $1,320 per year, an effective rate of 0.59%, significantly lower than Florida’s average. Popular with retirees and nature enthusiasts, Citrus County offers crystal-clear springs, manatee-filled waterways, and lush nature preserves.

Although property values here are higher—median home prices around $223,000—the taxes remain impressively low. Crystal River’s charm attracts visitors year-round, but it’s vital to remember the area’s vulnerability to hurricanes, such as the record flooding from Hurricane Idalia. Elevated insurance costs are a significant consideration despite low property taxes.

5. Gulf County

At the edge of Florida’s Panhandle, Gulf County provides coastal living along the beautiful Gulf of Mexico beaches, including Port St. Joe and Cape San Blas. The county’s effective property tax rate is about 0.57%, and average annual bills are roughly $1,334, just 43% of the state average.

Gulf County properties tend to be slightly pricier due to its desirable beach locations, with median home values around $236,000. While the property tax bills remain comparatively low, Gulf County’s exposure to storms like Hurricane Michael in 2018 means insurance premiums can be high and rebuilding costs significant if disaster strikes.

Balancing the Benefits and the Risks

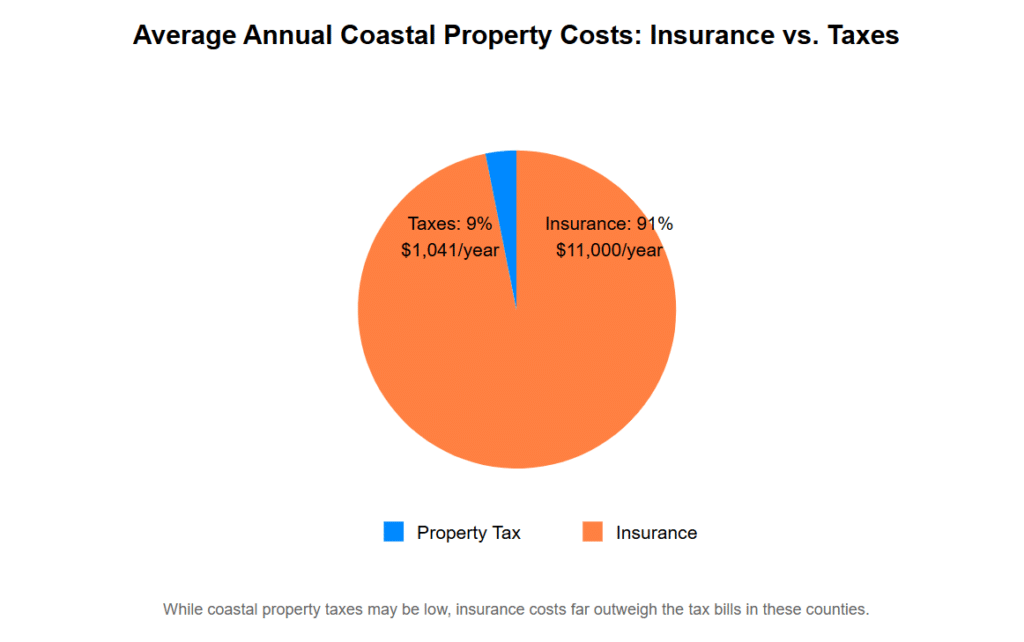

These five counties undoubtedly offer some of the lowest property taxes you’ll find anywhere along Florida’s extensive coastline. However, it’s essential to approach these savings realistically:

- Insurance Costs: Florida’s coastal counties have some of the highest home insurance rates nationwide, often significantly surpassing property tax savings. Expect annual insurance premiums to range between $8,000 and $11,000.

- Hurricane Risk: Each of these counties has experienced significant hurricane impacts in recent years, highlighting the importance of factoring in storm preparedness, evacuation plans, and potential rebuilding costs.

- Infrastructure and Services: Lower tax revenue often means fewer public services and potentially additional out-of-pocket expenses for amenities residents in higher-tax areas might take for granted.

What About Second Homes or Vacation Properties?

Florida’s property tax structure distinctly favors primary residences through homestead exemptions and the Save Our Homes cap, which restricts annual assessment increases to 3%. Non-homestead properties, including second homes and vacation rentals, lack these protections, with assessments allowed to increase by as much as 10% annually. While tax rates themselves don’t change, the absence of homestead benefits can mean notably higher tax bills for vacation or investment properties.

The Future of Florida Property Taxes

Governor Ron DeSantis’ recent proposals to significantly reduce or even eliminate property taxes add another layer of uncertainty. While appealing to voters frustrated by rising property taxes, eliminating property taxes altogether would likely require substantial hikes in other taxes—such as doubling the sales tax—or significant service cuts. Thus, homeowners planning a purchase should carefully watch these developments while focusing on present affordability.

Is Low-Tax Coastal Living Right for You?

Choosing one of these coastal counties depends on your personal priorities. If your dream includes a quiet coastal retreat with manageable annual costs, the counties listed offer a compelling mix of low taxes and coastal charm. They’re especially attractive for retirees, remote workers, or anyone seeking a simpler pace of life without sacrificing the appeal of waterfront living.

However, prospective homeowners must balance property tax savings against additional living expenses, particularly insurance and storm-related costs. A low tax bill is just one aspect of total homeownership affordability in Florida’s coastal regions.

Final Thoughts

Despite rising costs elsewhere, Florida’s lesser-known coastal counties provide an appealing alternative to popular—and expensive—locations like Miami or Naples. Counties like Dixie, Taylor, Levy, Citrus, and Gulf remain affordable havens with exceptionally low property taxes.

In today’s changing tax and real estate environment, it’s more important than ever to carefully evaluate all factors when choosing your new Florida home. If coastal living with minimal property taxes appeals to you, exploring these hidden gems could be your ticket to affordable paradise.