If you’ve ever looked at Commercial Real Estate, chances are you’ve seen the term “cap rate”. But what exactly is the importance of this number?

On This Page

What is a CAP Rate?

The cap rate (or capitalization rate) shows the rate of return from an investment property. It’s a number used estimate the potential investor’s rate of return. Analysts calculate the cap rate based on the net income of the property.

How Do you Calculate the CAP Rate?

The capitalization rate is not a value obtained easily. As a professional opinion, it’s commonly seen as a very negotiable number. The best way to reach one is using a professional business valuator.

Before determining the cap rate of a particular property, a few pieces of data about the potential investment are required.

Net Operating Income

The Net Operating Income, or NOI, is the final annual income achieved by the property. It is determined by taking the sum of all sources of income (rent, mineral rights, royalty fees etc) and subtracting the expenses of managing the property (such as maintenance & common area fees).

Current Market Value

The second important piece of information is the property’s market value. If the property was recently bought or sold, that figure would be used. However, if the property has not recently been involved in a transaction, the current market value can be obtained through comparable sales.

Sale comparisons, (also referred to as comps) are similar sales to the specific property being analyzed. To qualify as a comp, the property should be similar in size, location, and construction as the property in question. It’s also important to ensure that the source of income is the same as the property being analyzed. Different asset classes trade at different CAP rates, and it is important to group like properties together. For example multifamily assets trade at completely different valuations as opposed to industrial or retail properties.

Even within asset classes, sub-categories may be used. For example, a duplex or triplex rental property may have a different expectation of income compared to a 20+ unit apartment building.

Typically a comp is determined and adjusted by a REALTOR, in cooperation with a business valuator, if applicable.

What is the Cap Rate Formula?

The formula for the capitalization rate is:

cap rate = net operating income / current market value

Illustrating the Point

Let’s say that there is an income property listed for sale at $2,000,000. If the advertised cap rate is 10%, then a simple calculation can be done to estimate the annual income.

$2,000,000 * 10% = $200,000/year

In this scenario, it has been determined that the potential investor would see 10% of his investment returned per year, or $200,000. After 10 years, the investor would recover his entire investment, while continuing to hold the asset that generated the return.

How Are Cap Rates Determined?

CAP Rates are often the driving factor behind many commercial real estate transactions. As a result, it is often disputed amongst professionals. However, larger commercial real estate brokerages and informatics firms typically have a team dedicated to market analysis and thus determination of the current CAP rate.

This creates the question: do market comps create the CAP rate? Or is the rate driving sales at those prices? The answer is a bit complex, as it is essentially, both.

High or Low – Which is better?

The CAP Rate is inversely proportional to the value of an asset. A higher figure indicates that the value of the property will be lower, and vice versa.

As with all investments, the goal is to “buy low, sell high”. The prudent investor will attempt to purchase investments with a high rate of return (and therefore low sale price) and sell them when the market returns are far lower, thereby maximizing the return on principal.

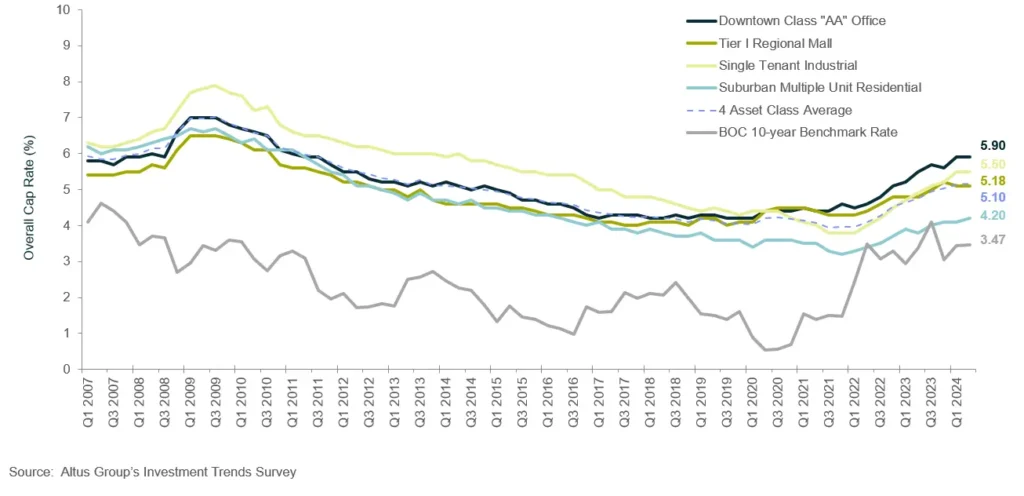

In recent months, low interest rates and cost of borrowing has sparked a phenomenon known as “Cap Rate Compression.” Low returns across all interest-backed investments (such as bonds & GICs) has lowered the expected return on Real Estate. As a result, prices on income-generating properties have risen compared to their annual return.

With that being said, CAP rates are considered relative to a market. Low rates are typically the indicator of a market with “inefficient capital“. Your return on a property may be better than every other property, but if your funds will yield a better return in other investments, then careful consideration should be given.

When evaluating a property using the income approach, no additional value is typically given to the structures or improvements upon that property. For this reason, the idea that income-generating properties provide capital appreciation should be disregarded.

CAP Rate Vs IRR

The Capitalization rate should not be confused with the internal rate of return (IRR).

The IRR is a calculation of an investments return internally, vs just a calculation of straight cash return.

This might sound confusing, and it certainly seems as though it’s meant to be. IRR takes into account capital invested + capital borrowed, and gives you a clearer picture of the return on your funds contributed. This is different than a straight calculation on a return vs an asset’s price.

The Risks of a Cap Rate

The single biggest risk of a cap rate is its reliance on income consistency. Economic shifts, political unrest, and a community’s GDP all affect the potential for the property in question to consistently achieve the annual income. It is for this reason that the estimation of a property’s NOI not be taken lightly.

Catalyst’s team of professional Toronto Realtors, integrated with expert legal service from seasoned lawyers can assist you with calculating the cap rate for your next potential property. Contact us today.