While it might seem that concurrent ownership of land in Ontario is a straightforward topic, the opposite is actually true. When looking to purchase a property, its important to consider the manner in which you hold title. Considering Joint Tenancy vs Tenants in Common should not be a rushed affair.

In Ontario, concurrent (two or more party) ownership is primarily divided into two categories: Joint Tenancy, and Tenants in Common.

While they may on the surface seem similar, the effect of each type of ownership could mean the difference between having any control whatsoever over the land, and simply being brought “along for the ride”.

On This Page

Joint Tenancy

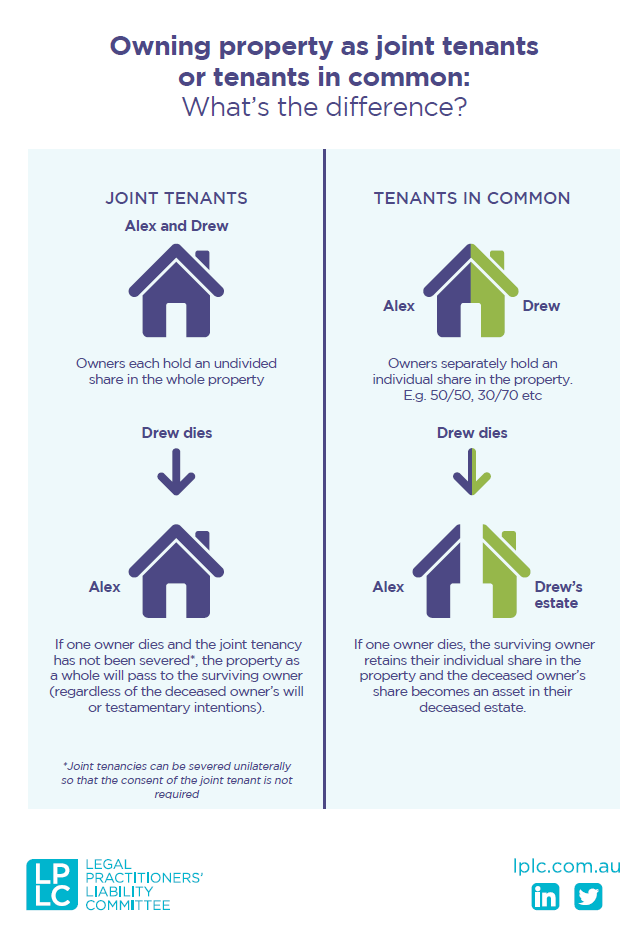

Joint Tenancy is the ownership of land by two or more persons. On the death of one, the surviving parties get the whole interest in the property.

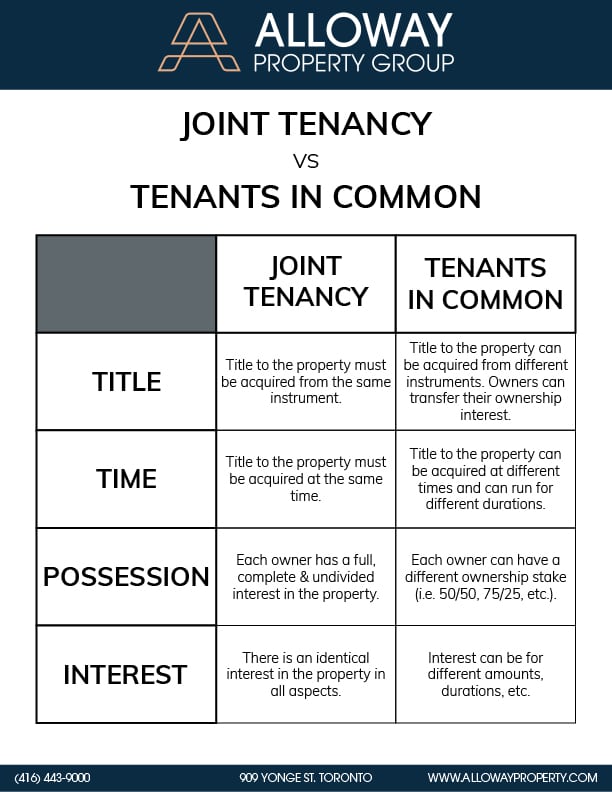

To achieve Joint Tenancy, four key requirements (or “unities”) must be satisfied: Title, Time, Possession, and Interest. (THINK: PITT)

Title

One of the main requirements of Joint Tenancy is that all tenants must receive or derive their title from the same instrument. This document could be in many forms, such as a Deed or a Will. It is important that the same document is used in claiming ownership between all the parties, or the possession may not be qualified as Joint Tenancy.

Time

Another important unity required to achieve Joint Tenancy is Time. The interest of each joint tenant MUST begin at the same time. In no way can a joint tenant’s possession begin before or after the others; in that case it would no longer be considered Joint Tenancy.

Possession

Possession is the most interesting of the four unities. In the eyes of the law, each party does not hold a partial possession of the property. Rather, each owner is entitled to an undivided possession of the whole property, without exclusion of the other owners.

In other words, each tenant owns equal interest in the whole property, while having no interest in a fraction of the property. In the case of four joint tenants, the four would not hold 25% of the property each, but they would instead each hold 100% interest of the property.

Interest

In Joint Tenancy, each joint tenant must hold an identical interest in the property in all aspects, including nature, extent, and duration.

Joint Tenancy: Survivorship

Joint Tenancy is survivable. This means, in the event that one of the Joint Tenants passes, the tenancy is passed to the surviving owners. This is particularly useful when the home is placed in tenancy between spouses. In the event of the passing of one spouse, ownership immediately transfers to the remaining spouse!

An interesting caveat to Joint Tenancy is when it comes to matrimonial homes. Matrimonial homes have been deemed by the government to be a home that was purchased during marriage. In the event that the deceased held joint tenancy with someone OTHER than the spouse, the tenancy is severed immediately before the death, creating a tenants-in-common relationship. This relationship survives the deceased and extends to the estate of the deceased, which gives the deceased’s spouse claim to a portion of the matrimonial home.

Pros: Joint Tenancy

There are advantages to choosing a Joint Tenancy arrangement over a Tenants in Common. For example, survivorship interests ensure that a loved one won’t have title issues when a spouse dies. The undivided interest can also have certain mortgage and tax advantages.

Cons: Joint Tenancy

The largest drawback to Joint tenancy is the nature of the survivorship. For example, if there are more than two parties with a Joint Tenancy, upon the death of one, the ownership arrangements can be extremely complicated. In the case of Real Estate, matrimonial issues of the deceased’s spouse may pose issues.

Tenants In Common

Without the 4 unities, a tenants in common arrangement is typically established. Instead of each person owning an undivided interest in the property, the interest in the property is typically divided between multiple individuals. Unlike Joint Tenancy, no survivorship exists.

Pros: Tenants in Common

The biggest advantage of Tenants in common is the ability to assign different percentages of ownership between parties. Since TIPP is not required, different entities can buy, sell, trade, or exchange their fractions at different points in time.

Further, Tenants in Common does not require Title to be acquired from the same instrument. A fractional owner of an investment could, for instance, leave that fraction to their descendants in their will. The beneficiary would receive essentially identical

Cons: Tenants in Common

Survivorship can be viewed as a pro or con, depending on the situation. When owners do not want to reserve right for their estate, for example, the process of claiming the remaining portion of ownership left can be cumbersome.

The Difference Between Joint Tenancy and Tenants in Common

In Joint Tenancy, each owner has an undivided share of the property. By contrast, a Tenants in Common ownership structure causes each owner to have a divided, or fractional share.

An easy way to understand this is to think of a pizza. While on the table and in the box, the pizza can be considered owned or wholly belonging to those sitting around it (JT). However, when an individual takes slices from the pizza and divides them by allocating them to plates, the pizza is fractionally owned by each person at the table (TiC).

Important Considerations in Title

When determining the manner in which you should take title to a property, its important to understand the implications of Joint Tenancy vs Tenants in Common.

For example, if you’re planning to apply for a mortgage, the financial institution will apply different scoring practices for joint tenancy than for tenants in Common.

A joint tenant does have the right to unilaterally sever the joint tenancy by transferring the property to themselves. This creates a tenants in common relationship. However, the Family Law Act contains stipulations related to ownership shares and spousal rights, which override any perceived benefits due to the severance.

Still have questions about concurrent ownership? Why not Contact Us today for a free consultation on the ownership of your property.