Buying a home in Toronto is one of the biggest financial commitments most people will ever make. Beyond the mortgage or condo fees, every property carries one unavoidable expense: property tax. For many homeowners and investors, property tax is one of the largest ongoing costs of ownership; and yet it’s often misunderstood.

This guide explains exactly how Toronto property tax works, how MPAC assessments are calculated, what happens when you renovate or add a suite, and how to handle everything from appeals to arrears. Whether you’re a first-time buyer, a landlord, or planning a major renovation, understanding the system can save you thousands.

On This Page

What is Property Tax?

Property tax is an annual levy charged by the City of Toronto on all real estate. It funds everything from roads and transit to fire services, garbage collection, and education. Unlike land transfer tax, which is a one-time closing cost, property tax is recurring (every year you own the property).

Under Ontario’s Municipal Act (Part VIII: Municipal Taxation), municipalities have authority to set tax rates, collect payments, issue penalties, and enforce collection. In fact, unpaid property taxes have “super priority” status: they can even outrank mortgages and liens when enforced.

How Property Tax is Calculated in Toronto

The MPAC Assessment

Every property’s tax bill starts with its assessed value, determined by the Municipal Property Assessment Corporation (MPAC). MPAC re-assesses values on a four-year cycle. To avoid “sticker shock,” new values are phased in over four years, with one quarter of the increase applied annually.

Example:

If MPAC reassesses your home at $1,000,000, up from $800,000, the $200,000 increase is phased in at $50,000 per year for four years.

Homeowners receive a Property Assessment Notice whenever a new cycle begins, or when MPAC updates a property due to changes like renovations or class adjustments.

Based on this phased-in value, the City of Toronto (or local municipality) will apply a predetermined tax rate to your property and issue bills accordingly.

Appealing Your Property Tax Assessment

If you believe MPAC’s assessed value of your property is inaccurate, Ontario law gives you the right to challenge it. The process begins with a Request for Reconsideration (RfR). This is a free, homeowner-initiated review where you can present evidence showing that the assessed value does not reflect the property’s true condition or market comparables.

Strong evidence might include:

- Comparable recent sales in your neighbourhood

- Building permits and architectural drawings

- Photographs documenting the size and layout of the home

- Professional appraisals

Submitting clear documentation can often resolve errors quickly. For example, if MPAC counted an unfinished basement as living space, an RfR supported with photos and floorplans can correct that.

If MPAC denies or only partially adjusts your RfR, the next step is the Assessment Review Board (ARB). The ARB is an independent tribunal where property owners, municipalities, and MPAC present evidence before a panel. Decisions made by the ARB are binding.

An ARB hearing is more formal than an RfR. You may choose to represent yourself, but many homeowners, particularly those with higher-value properties or income-producing real estate, engage professionals such as real estate brokers, appraisers, or tax consultants to build a stronger case.

The ARB process can take time, but it can also result in significant savings if your assessment is materially overstated. For investors, even a small reduction in assessed value can improve long-term returns by lowering annual carrying costs.

Toronto Property Tax Rates

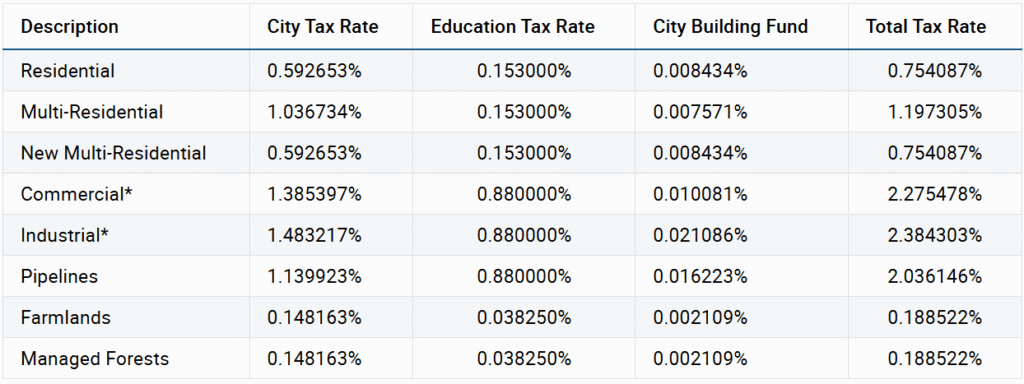

Once the assessed value is set, the City applies its tax rate. Toronto’s tax rate has three components:

- City Tax Rate (funds operating budget)

- Education Tax Rate (set provincially, remitted to school boards)

- City Building Fund (dedicated to transit and housing)

The combined rate is applied to the phased-in MPAC value. Rates vary annually, so the most reliable way to check your bill is by using the City of Toronto’s Property Tax Calculator.

Interim Tax vs Final Tax

As property tax is a large obligation relative to other (non-financing) home ownership costs, cities typically want to ensure residents have enough time.

Toronto issues two bills each year:

- Interim Bill (March–May): Based on 50% of the previous year’s total. Acts as a deposit until final rates are set.

- Final Bill (July–September): Adjusts for actual tax rates passed in the City’s budget, plus or minus the interim estimate.

Installment Dates (2025):

- Interim: March 1, April 1, May 2

- Final: July 4, August 2, September 1

Most owners choose equalized installments or a pre-authorized payment plan to spread costs across the year. The City of Toronto also allows these interim and final installments to be spread into monthly payments, for further budgeting and cash-flow calculation.

Renovations and Property Tax: How Improvements Trigger Reassessment

Most homeowners know that MPAC reassesses every four years as part of the province-wide cycle. These reassessments are meant to keep property values roughly aligned with the market, and the increases are phased in gradually to soften the impact on taxpayers.

But what many people don’t realize is that you can be reassessed between cycles if MPAC believes your property has undergone a “major change” often the result of renovations or a building permit being issued. In these cases, your home is effectively “flagged” for review, and MPAC will issue a new assessed value based on the upgraded condition of the property.

How Permits Trigger a Reassessment

When you apply for a building permit in Toronto, that information is automatically shared with MPAC. Permits don’t always result in reassessment, but they act as a signal to the assessor that something significant may be happening at your property. Once work is complete, MPAC may conduct a site review or use permit details, architectural drawings, and completion reports to decide if a reassessment is necessary.

What Counts as a “Major Change”

Not every project will increase your taxes. Cosmetic updates (painting, refinishing floors, swapping out cabinets) are unlikely to move the needle. MPAC focuses on changes that increase the property’s livable area, utility, or classification.

Common examples include:

- Adding above-grade square footage. Finishing an attic into bedrooms, adding a second storey, or building an extension will almost always trigger reassessment.

- Adding bedrooms or bathrooms. More rooms translate into higher utility and value in MPAC’s model.

- Secondary units. Basement apartments, laneway suites, or garden suites typically change the property’s income potential and will be factored into the new value.

- Auxiliary structures. Pools, garages, sheds, and large outbuildings may increase value and, in turn, taxes.

- Class changes. A single-family property converted into a multi-residential dwelling may shift into a different tax class, with higher rates.

Timing of Reassessment

If MPAC reassesses you as part of the four-year cycle, the new value is phased in over the next four years. But if you are reassessed because of renovations, the increase is applied immediately, and the City may issue a supplementary tax bill to cover the difference retroactive to the date the improvements were considered complete.

This can lead to surprise costs. For example, if you complete a laneway suite in 2023 and MPAC updates the roll in 2024, you may receive a supplementary bill covering the increase for part of 2023 and all of 2024. In cases where the completion date is disputed, owners sometimes find themselves owing “back taxes” for periods when the improvements weren’t even finished.

Documentation is Critical

Because reassessments after renovation can be imprecise, it is crucial for homeowners to keep detailed records:

- Permit applications and approvals

- Architectural drawings

- Completion certificates or occupancy permits

- Contractor invoices and progress records

- Photos showing before/after conditions

These records can be used to dispute incorrect assumptions. For example, an assessor may overstate the finished square footage by including double-height open spaces as usable floor area. In one real-world case, a homeowner had to challenge both the measurement and the backdated completion date, and succeeded only because they had thorough documentation.

Cosmetic vs. Structural Improvements

It’s also important to understand that not every renovation raises taxes. Refinishing a kitchen with new cabinets or replacing windows is unlikely to trigger reassessment. MPAC is primarily concerned with structural improvements and income-generating changes.

Think of it this way: if your renovation makes the property bigger, more functional, or more marketable as a rental, expect MPAC to notice. If it simply makes your home nicer to live in without adding space or utility, your taxes are less likely to change.

Vacant Home Tax in Toronto

Since 2023, Toronto has introduced the Vacant Home Tax (VHT), a measure aimed at encouraging owners to put empty properties back into use. The tax is set at 1% of a property’s current MPAC-assessed value, which can translate into thousands of dollars for homeowners who leave a property unoccupied for much of the year.

The City requires every residential property owner to file an annual occupancy declaration, even if the property is fully lived in. Failing to declare, or submitting a false declaration, can result in fines in addition to the tax itself.

For owners, this means planning ahead: if you intend to leave your property vacant for more than six months, it’s important to understand the exemptions (for example, estate sales, major renovations, or hospitalizations) and to document them carefully. Investors and second-home buyers should factor this cost into their annual carrying expenses.

Property Tax Relief Programs

Property tax can be a heavy burden, particularly for seniors, people with disabilities, or owners experiencing financial hardship. Toronto offers several relief programs designed to provide flexibility.

- Deferral Programs – Eligible low-income seniors and disabled persons can apply to defer property tax increases or, in some cases, defer taxes entirely until the property is sold.

- Cancellation Programs – In specific cases of hardship, certain taxes or penalties may be cancelled.

- Pre-Authorized Payment Plans – These plans spread property tax payments over the year, either monthly or seasonally, reducing the impact of lump-sum due dates.

- Charity Rebates – Registered charities that occupy commercial or industrial properties may apply for partial rebates.

Each program has eligibility requirements, so homeowners should check the City of Toronto’s official resources or speak with a real estate professional to determine if they qualify.

Arrears: Risks & Consequences

Falling behind on property tax payments can have serious consequences. Unlike most debts, property tax arrears have “super priority” status, meaning they take precedence over mortgages, condo liens, or other charges on title.

If taxes remain unpaid, the City will apply monthly interest and penalties, quickly compounding the amount owed. After two years of arrears, Toronto has the legal authority to initiate a tax sale of the property to recover outstanding amounts.

For homeowners, this underscores the importance of staying current or seeking relief before arrears accumulate. For investors, tax arrears on a property you plan to purchase can create complications, as the City will enforce payment regardless of other encumbrances.

Even in difficult situations, options exist. Setting up a payment plan, applying for deferrals, or appealing supplementary assessments can all help prevent arrears from snowballing into forced collection.

Final Thoughts

Toronto property tax is far more than just a percentage of your home’s value. From phased-in MPAC assessments to surprise supplementary bills after renovations, understanding the system can save you money — and stress. For homeowners planning upgrades, investors managing cash flow, or anyone worried about an assessment, professional advice can make a real difference.

Alloway Property Group is here to help you navigate property ownership in Toronto. Whether you’re buying, renovating, or disputing your assessment, our team can provide the insight and representation you need. Contact us today for a free consultation.